Why Net Worth Skyrockets After $100k 🚀

“The first $100,000 is a bitch, but you gotta do it… I don’t care what you have to do… If it means walking everywhere and not eating anything that wasn’t purchased with a coupon, find a way to get your hands on $100,000.” -Charlie Munger

In this newsletter, I’m going to share with you 3 reasons why your net worth will explode after reaching the $100k milestone, 2 reasons why the first $100k is the hardest, and 6 practical strategies you can use today to get to that first $100k faster. With that said, let’s dive in!

Reasons Why Your Net Worth Skyrockets After $100,000

Reason #1: Scale of Capital

To illustrate the idea of the scale of capital, let’s compare John, who has $1000 invested, and Mary, who has $100,000 invested. Both achieve a 10% return. John earns $100 and has an ending balance of $1,100. Mary, on the other hand, earns $10,000 and has an ending balance of $110,000. The amount earned is different. Why? Because a 10% return on $1000 is only $100, while a 10% return on $100,000 is $10,000. Once you hit $100k, your net worth hits critical mass. Critical mass is “the minimum amount of materials needed to achieve a self-sustaining chain reaction.” In personal finance, your first $100k is the critical mass because compounding starts to take over. Even if you don’t contribute another dollar, it’s only a matter of time for it to grow into $1 million. Blake from PathwaytoFI showcases this

Reasons #2: Compounding

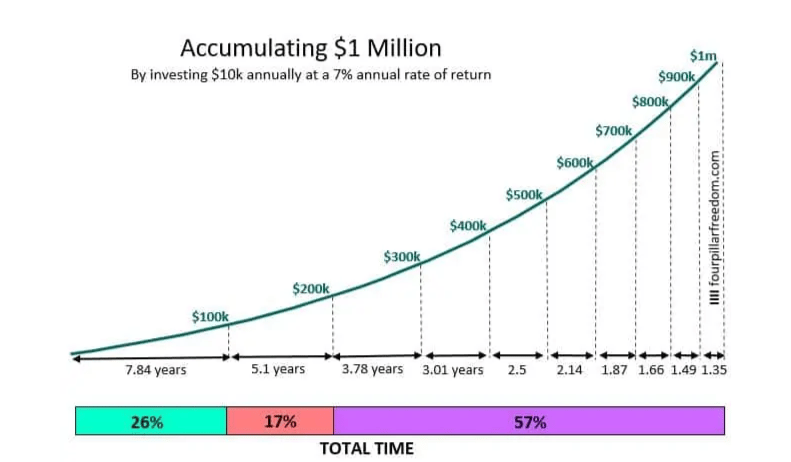

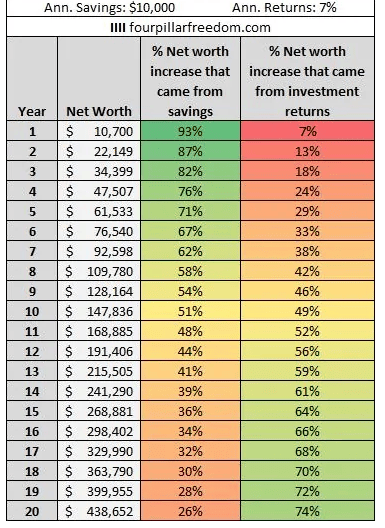

Einstein is attributed to saying that “Compound interest is the eighth wonder of the world.” As your net worth grows, the amount of time to get to the next milestone gets faster. Going from $100k to $200k is 35% faster than the first $100k. Assuming you invest $10,000/year and earn a return of 7% annualized return, it will take 7.84 years to reach the $100k milestone. If you keep contributing the $10,000 and assuming the 7% return, it will take 5.1 years to get to $200k. This is because compounding takes over the savings rate at year 11.

Fun fact, if you were to save $20,000, double the $10,000, compounding will still take over the savings rate at year 11 too. As many say “It takes money to make money”

Reason #3: Breaks Mental Barriers

To build wealth, one of the first steps is to change your mindset around it by believing that you can build wealth. Seeing $100,000 to your net worth breaks the limiting beliefs you have. Especially when you don’t come from money, this is a big accomplishment. This milestone increases your momentum as it motivates you to grow your wealth faster

2 Reasons Why the First $100k is the Hardest

Reason #1: Earning Power

When you are young, you have the lowest income at the beginning of your career because you don’t have experience yet. According to a study by Bergen Record, Gen Z has 86% less buying power than baby boomers did when they were in their 20s. Saving money requires a lot of sacrifice and self-discipline. Saving money on a low income is hard and requires discipline and good money habits.

Reason #2: Lack of Compound Interest

The majority of your first $100k comes from the amount you save. In fact, 60% of the first $100k saved will come from the contributions you made. Compound interest doesn’t help until after $100k. Zach from Four Pillar Freedom states, “The first $100k takes the longest because you don’t benefit from investment returns early on… The amount of time it takes you to $100k is dependent on your savings rate.” Because of the lack of compound interest, it will seem to take forever to get to $100k. Getting to the first $100k takes the longest, amounting to 26% of the total time to get to $1 million.

Going back to the scale of capital concept, we know that this gives us an advantage when working with large numbers >$100k, but in the first few years, we don’t have this advantage. Let me explain

10% return on $1000 = $100, while 10% return on $100k is $10,000. Despite earning the same return, compound interest doesn’t account for much early on. This is why prioritizing your savings rate > investment rate early on is crucial

Now that you understand the importance of getting to the $100k net worth milestone and why it’s difficult to achieve it, here are 6 strategies you can implement today to get on the right path

6 Strategies to Get to $100k Faster

1. Keep fundamental costs low (housing, food, transportation)

Your fundamental costs are your largest expense categories that require you to live and work. These expenses are housing, food, and transportation. The only way to keep fundamental costs low is by tracking and budgeting your expenses.

2. Automate your finances

By automating your investment contributions, you make building wealth easy and seamless. A great benefit of automating your finances is that automating has been proven to increase savings rates by 3.89x. This is because it decreases the friction it takes to move money from your bank account to your brokerage account

3. Earn more

You can only save so much. While your downside (savings) is limited, your upside (income) is unlimited. By earning more you can increase your savings rate, which will get to $100k faster. Here are 6 ways to earn more money:

Negotiate your salary and ask for a raise

Change jobs

Start a side hustle

Get certifications

Invest more

Develop a high-income skill

4. Maximize Your Money’s Efficiency

Investing in a regular taxable brokerage account is inefficient because of the taxes you pay. Instead, invest in tax-advantaged accounts like a Roth IRA, Traditional IRA, and/or employer-sponsored 401(k) plans. You can also hold short-term savings in a High Yield Savings Account (HYSA), which will give you a higher interest rate than your bank account.

5. Increase Your Investment Horizon

There are three components to compound interest; the amount of capital invested, the rate of return, and the time horizon. It’s important to have the longest time horizon even if you don’t have a lot to start. Start early, start with what you have

6. Focus on increasing your Savings Rate Rather Than Investment Returns

You can’t control your investment returns but you can control how much you invest

$200/mo x 12% return over 30 years = $600k

$400/mo x 10% return over 30 years = $800k

Prioritize your savings rate over your investment rate

Summary:

Getting to the first $100k comes down to being smart with your money, increasing your income, and minimizing your expenses. Remember what Charlie Munger said, “The first $100,000 is a bitch, but you gotta do it.” If you want a wealthy life, strive to reach a $100k net worth today.

“Wealth is more often the result of hard work, perseverance, and most of all self-discipline.” -Thomas Stanley, The Millionaire Mind