5 Signs That You’re On Track to Being a Multi-Millionaire

Wealth building is a long journey with lots of up-and-down moments. Some days it can feel hard to know if you are on the right track with your finances. But there are signs that you can use to let you know you are on the right track to becoming a multi-millionaire.

Here are 5 signs that you are on the right track to becoming a multi-millionaire

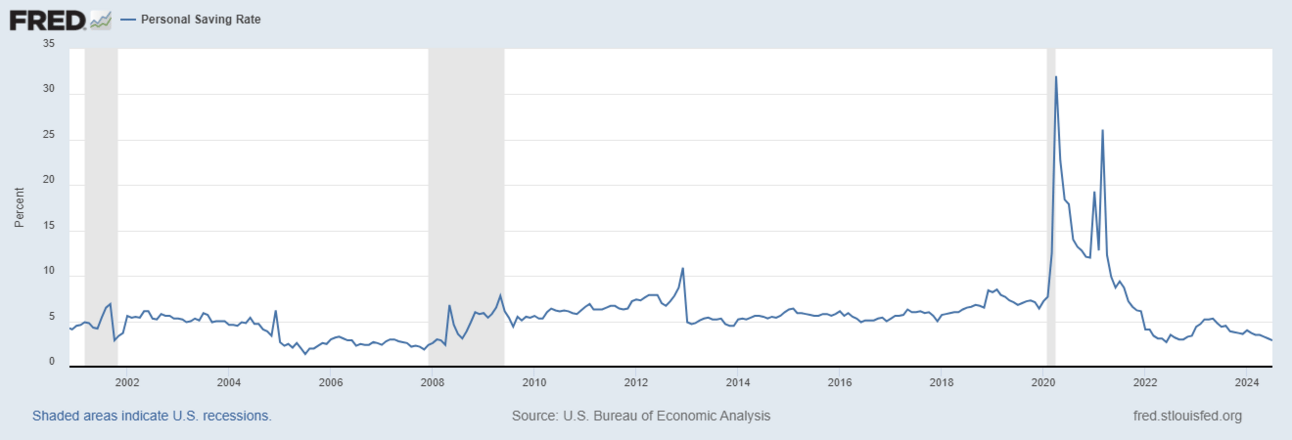

1. You Are Prioritizing a High Savings Rate

The average American has a savings rate of 3.4%

The majority of Americans feel like they can’t retire. This is because of their low savings rate. If you understand that your savings rate is correlated to how early you can reach financial independence, you are on the right path to millions. A high savings rate allows you to retire earlier.

Wealth builders have a 15% savings rate or higher. This allows you to invest more money. The more money you have working for you, the less time you have to work for a living.

Here is how much you save affects when you hit $1M status

if you invest $10,000 every year at 7% returns, it will take 30 years to hit $1M regardless of age

If you invest $20,000 every year at 7% returns, you will hit $1M status 8 years earlier regardless of age

If you invest $40,000 every year at 7% returns, you will hit $1M status in 15 years regardless of age

Let’s get more specific. Let’s say you make $65,000/year. Here is how the savings rate changes how fast you get to $1 Million (assuming 7% annualized returns)

Savings Rate | Amount Invested Per Year | Years to $1M |

|---|---|---|

5% | $3,250 | 46 years |

10% | $6,500 | 36 years |

15% | $9,750 | 31 years |

20% | $13,000 | 27 years |

30% | $19,500 | 22 years |

50% | $32,500 | 17 years |

A high savings rate is correlated to early retirement. Prioritizing your savings rate by saving and investing more of your paycheck puts you ahead of the majority of Americans on the path to multi-millions

If you have a high savings rate of >15%, you are on the right path

2. You Have/Want Multiple Streams of Income

You can’t rely on one source of income. That is putting all of your eggs in one basket. One layoff can derail your wealth building journey

Diversifying your income streams not only increases your income but allows you to continue building wealth when one source of income takes a hit. This creates stability and resiliency when it comes to your greatest wealth building tool, your income. Imagine losing your job during a layoff but you own a rental with cash flow or a side business that is cash flowing. That layoff won’t greatly impact you if you don’t diversify your income sources.

If you want to diversify your income, here are 5 ways you can do it:

Earned Income (W-2 job)

Investment Income (dividends)

Rental Income (real estate)

Interest Income (HYSA and bonds)

Business Profits (Owner Distributions)

Those who build wealth know that they can’t rely on one source of income. If you have/want multiple income streams, you are on the right path

3. You Are Avoiding Lifestyle Inflation

Earning extra money from a pay raise is tempting to spend on upgrading your lifestyle. Keeping your lifestyle constant while your income grows, allows you to reach freedom faster

Yes, reward yourself for accomplishing career goals, just don’t let your ego get ahead of your spending. That’s where people get into trouble when ego makes their spending decisions for them

You are on the right path if you understand that true wealth cannot be seen

People see a new car, but what they don’t see are the debt payments funding their lifestyle. People see an older car, but what they don’t see is no debt payments, more of the income going into wealth building assets

Lifestyle inflation distracts you from earning and investing more

Focus on earning more, keeping your costs down, and investing.

If you avoid lifestyle inflation you are on the right path

4. Your Liquid Net Worth Is Growing

Your liquid net worth is assets that you can convert to cash quickly. A savings account is a great example because you can go to an ATM and get cash in minutes. Examples of liquid accounts are; checking and saving accounts, and investing accounts. A house is not a liquid asset, because it’s hard to convert it to cash quickly

If you have investment and retirement accounts growing, you are on the right path

If you have checking and saving accounts (cash buffers and emergency fund) growing, you are on the right path

A growing liquid net worth shows that your saving and investing habits are working for you

5. You Are Maximizing and Optimizing Your Finances

You are on the right path if…

You are maxing out tax-advantaged accounts such as Roth IRAs and HSAs

You are tracking your spending and reviewing your budget each month

You are tracking your net worth each month

You are allocating your money to wealth building levers (investments, paying off high interest debt)

Summary

Wealth building is a long and tough journey. With many ups and downs, from job promotions to layoffs it’s hard to know if you are on the right track with your finances. But there are signs that you can use to let you know you are on the right track to becoming a multi-millionaire.

If you are not on the right track do the following. Prioritize a high savings rate, diversify your income sources, avoid lifestyle inflation, grow your liquid net worth, and maximize your finances through tax-advantaged accounts and proper budgeting

Thanks for reading. Be sure to subscribe to the newsletter. If you enjoyed reading this and found this helpful, share this newsletter with someone to help them on their financial journey

Best, Matt